Congressman John Boehner stated that he wants us to work until we are 70 so that we can fund Social Security. Since Boehner appears to spend most of his time at the beach, I think it is in bounds to tell him to "pound sand".

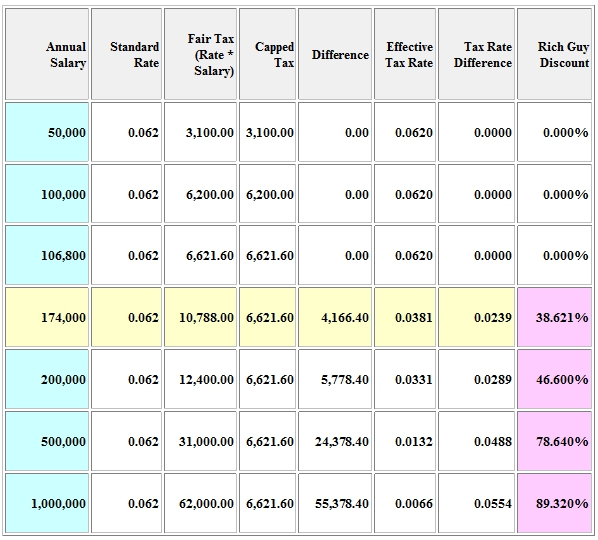

The Social Security Tax is 6.2% on the first $106,800 earned.

Hmm, all Congresspeople get $174,000 per year.

It's Math Time!!! (there are some rounding issues in the chart.)

Fair Tax is what everyone should be paying in a fair world.

Capped Tax is what people are paying today.

The difference in tax is simply Fair Tax - Capped Tax

The Effective Tax Rate is what those earning over the 106k limit are actually paying. What does $6,621 as the portion of Annual Salary (less than 1% for a $1 million baby)?

Tax Rate Difference is the difference between the Standard Rate and the Effective Rate.

The Rich Guy Discount is the amount of a break the rich guy gets.

I hope this ticks you off.

What this table demonstrates is an inverted graduated tax. That means the more you earn -- the less you pay. (Kinda the opposite of fair -- right.) Those who have the least ability to pay are hit with the brunt of this tax.

I am not proposing soaking the rich. I am proposing stopping the hammering of the middle class.

Making us work until 70 is the breaking point. The Democrats need to make this issue -- Removing the Social Security Tax Cap -- the focal point for the election.

Here is where I am going:

- If I gotta pay it -- You gotta pay it -- They gotta pay it.

- Tax Fairness. Is it fair that a $1 million baby gets a tax rate almost 90% less than someone making 100K?

- For those that say Congress' rules should apply to the rest of us. Their Effective Tax Rate (what they are actually paying) is 3.8% while those of us not so fortunate get the 6.2% rate.

- This table makes the case for removing the Cap on this tax BEFORE John Boehner demands we work until 70.

- President Obama promised that those earning less than 200k not have their taxes raised. That means in order to keep that promise those earning over 200k would be taxed at 6.2% for those monies over 200k. For the time being the flat amount of 6621 would remain in effect for those earning from 106k to 200k. Once you hit 200k - it is 6.2% on all of it.

If the Democrats want to win the election in November then John Boehner has given them more than ample opportunity. The Party of Donkeys needs to get in line and hammer the Party of No for even thinking this out loud with the current tax structure in place.

Tax Fairness will attack the GOP at it's strongest (?) point, which they think is finances and taxes. You want to vote your pocketbook then you have to vote for tax fairness. You won't get the entire Tea Party over to their side, but it will pressure the Tea Party inside the GOP.

If John Boehner wants the rest of us to work until 70 -- he needs to be put out of business along with the rest of the GOP and the Rich Guy Discount.

No comments:

Post a Comment